This function provides instantaneous forward rates. They can be used in no-arbitrage short rate models, to fit the yield curve exactly.

Arguments

- in.maturities

input maturities

- in.zerorates

input zero rates

- n

number of independent observations

- horizon

horizon of projection

- out.frequency

either "annual", "semi-annual", "quarterly", "monthly", "weekly", or "daily" (1, 1/2, 1/4, 1/12, 1/52, 1/252)

- method

specifies the type of spline to be used for interpolation. Possible values are "fmm", "natural", "periodic", "monoH.FC" and "hyman". See

spline; "HCSPL" (Hermite cubic spline) or "SW" (Smith-Wilson)- ...

additional parameters provided to

splinefun

Examples

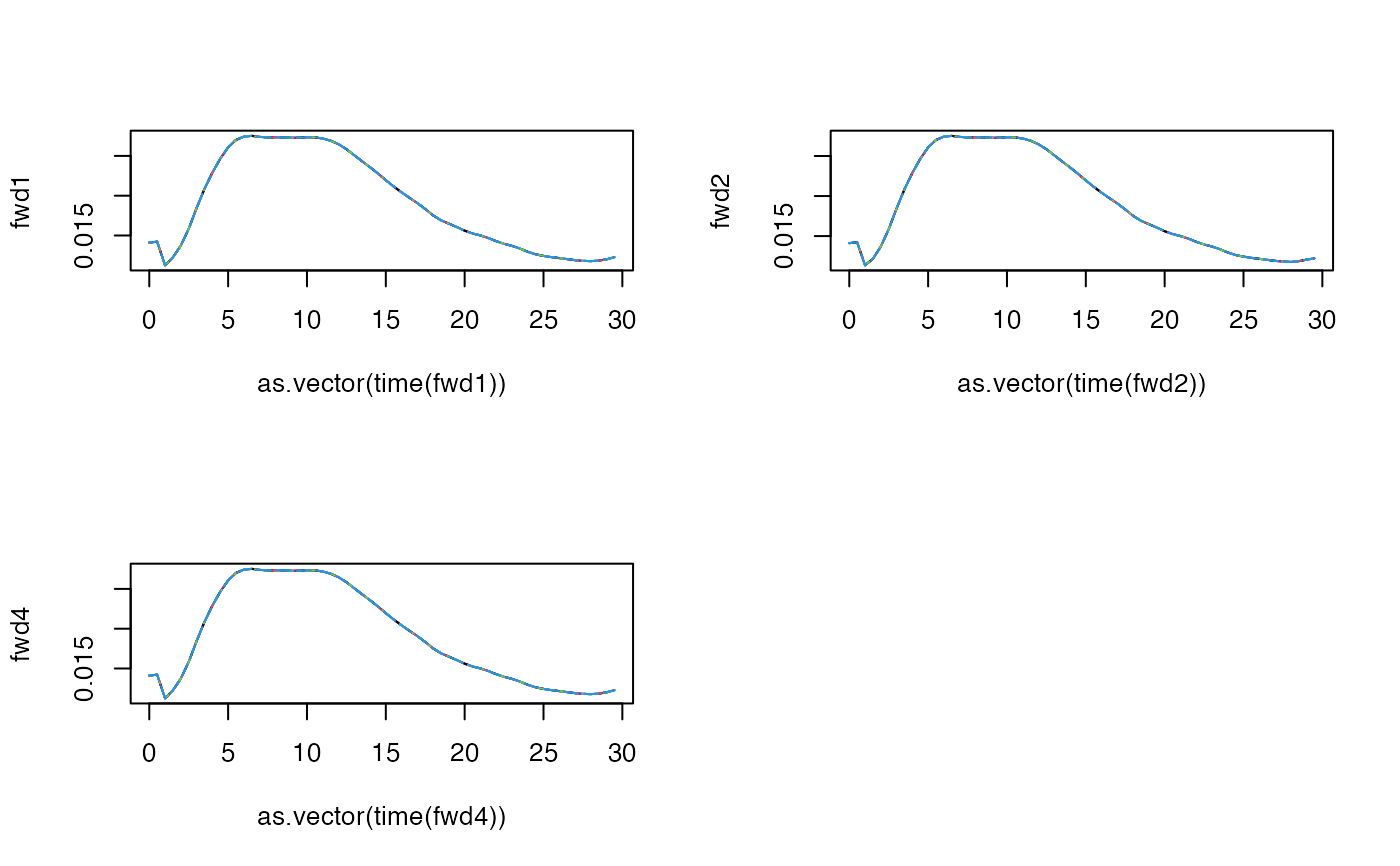

# Yield to maturities

txZC <- c(0.01422,0.01309,0.01380,0.01549,0.01747,0.01940,0.02104,0.02236,0.02348,

0.02446,0.02535,0.02614,0.02679,0.02727,0.02760,0.02779,0.02787,0.02786,0.02776

,0.02762,0.02745,0.02727,0.02707,0.02686,0.02663,0.02640,0.02618,0.02597,0.02578,0.02563)

# Observed maturities

u <- 1:30

par(mfrow=c(2,2))

fwd1 <- esgfwdrates(in.maturities = u, in.zerorates = txZC,

n = 10, horizon = 20,

out.frequency = "semi-annual", method = "fmm")

matplot(as.vector(time(fwd1)), fwd1, type = 'l')

fwd2 <- esgfwdrates(in.maturities = u, in.zerorates = txZC,

n = 10, horizon = 20,

out.frequency = "semi-annual", method = "natural")

matplot(as.vector(time(fwd2)), fwd2, type = 'l')

fwd4 <- esgfwdrates(in.maturities = u, in.zerorates = txZC,

n = 10, horizon = 20,

out.frequency = "semi-annual", method = "hyman")

matplot(as.vector(time(fwd4)), fwd4, type = 'l')