This function performs martingale and market consistency (t-)tests.

esgmartingaletest(r, X, p0, alpha = 0.05, method=c("onevsone",

"trend",

"ratio"))Arguments

- r

a

numericor a time series object, the risk-free rate(s).- X

a time series object, containing payoffs or projected asset values.

- p0

a

numericor a vector or a univariate time series containing initial price(s) of an asset.- alpha

1 - confidence level for the test. Default value is 0.05.

- method

"onevsone", "trend", "ratio".

Value

The function result can be just displayed. Otherwise, you can get a list by an assignation, containing (for each maturity) :

the Student t values

the p-values

the estimated mean of the martingale difference

Monte Carlo prices

References

T. Moudiki (2024), A test of the Martingale Hypothesis, https://www.researchgate.net/publication/388490056_A_test_of_the_martingale_hypothesis

See also

Examples

r0 <- 0.03

S0 <- 100

set.seed(10)

eps0 <- simshocks(n = 100, horizon = 3, frequency = "quart")

sim.GBM <- simdiff(n = 100, horizon = 3, frequency = "quart",

model = "GBM",

x0 = S0, theta1 = r0, theta2 = 0.1,

eps = eps0, seed=10)

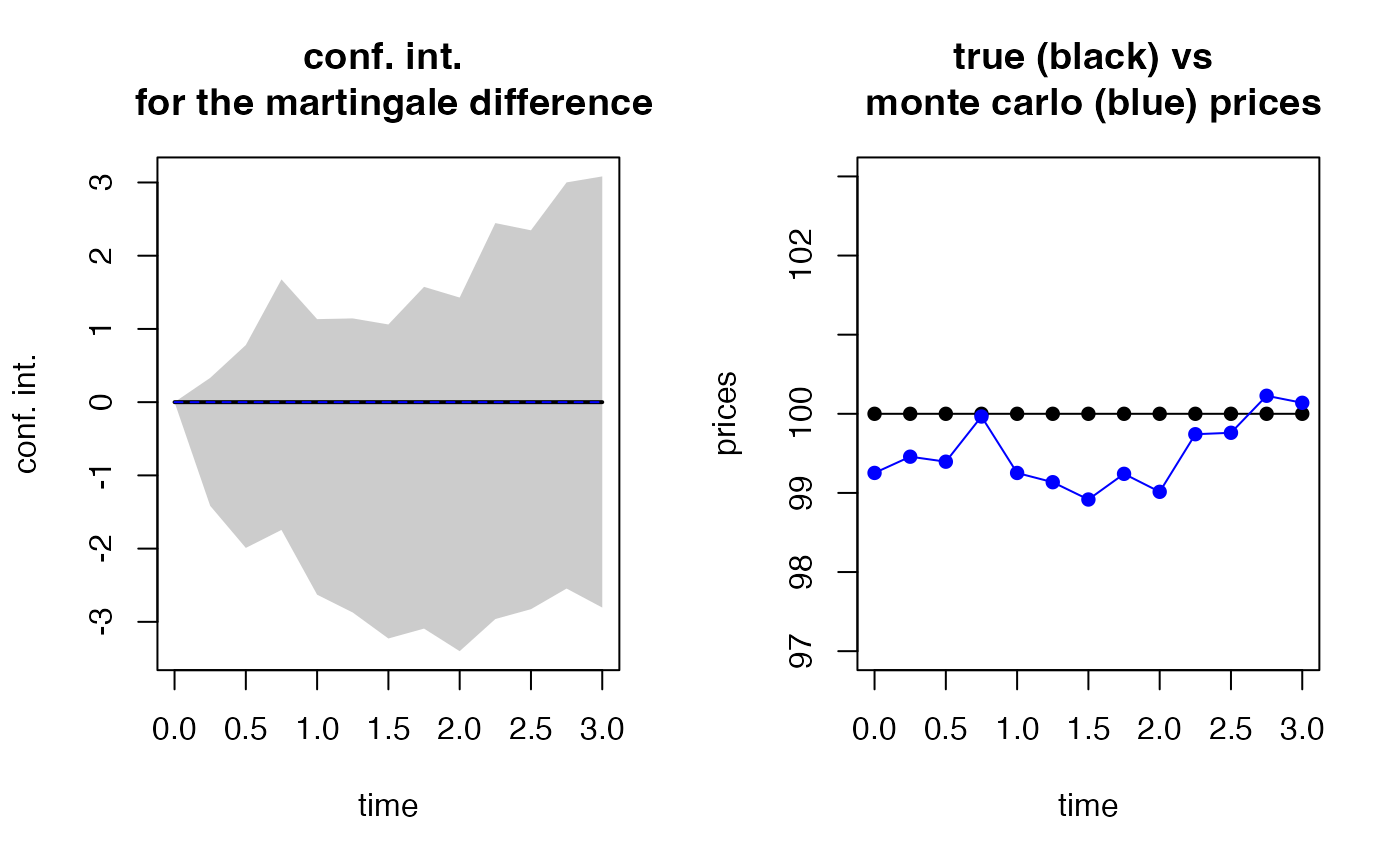

mc.test <- esgmartingaletest(r = r0, X = sim.GBM, p0 = S0,

alpha = 0.05)

#>

#> martingale '1=1' one Sample t-test

#>

#> alternative hypothesis: true mean of the martingale difference is not equal to 0

#>

#> df = 99

#> t p-value

#> 0 Q2 -1.23133508 0.2211146

#> 0 Q3 -0.86706246 0.3880045

#> 0 Q4 -0.03979258 0.9683386

#> 1 Q1 -0.78853728 0.4322667

#> 1 Q2 -0.85421446 0.3950485

#> 1 Q3 -1.00243504 0.3185774

#> 1 Q4 -0.64526489 0.5202482

#> 2 Q1 -0.81032744 0.4196956

#> 2 Q2 -0.18944936 0.8501285

#> 2 Q3 -0.18407588 0.8543305

#> 2 Q4 0.16306302 0.8708012

#> 3 Q1 0.09358936 0.9256245

#>

#> 95 percent confidence intervals for the mean :

#> c.i lower bound c.i upper bound

#> 0 Q1 0.000000 0.0000000

#> 0 Q2 -1.415461 0.3314127

#> 0 Q3 -1.990430 0.7798667

#> 0 Q4 -1.744826 1.6762189

#> 1 Q1 -2.629092 1.1337289

#> 1 Q2 -2.872560 1.1435895

#> 1 Q3 -3.227314 1.0608930

#> 1 Q4 -3.092177 1.5745601

#> 2 Q1 -3.400502 1.4284311

#> 2 Q2 -2.961712 2.4454467

#> 2 Q3 -2.826997 2.3470049

#> 2 Q4 -2.545313 3.0011186

#> 3 Q1 -2.804901 3.0825960

esgplotbands(mc.test)