This function plots colored bands for time series percentiles and confidence

intervals. You can use it for outputs from simdiff,

esgmartingaletest, esgcortest.

esgplotbands(x, ...)Arguments

- x

a times series object

- ...

additionnal (optional) parameters provided to

plot

See also

Examples

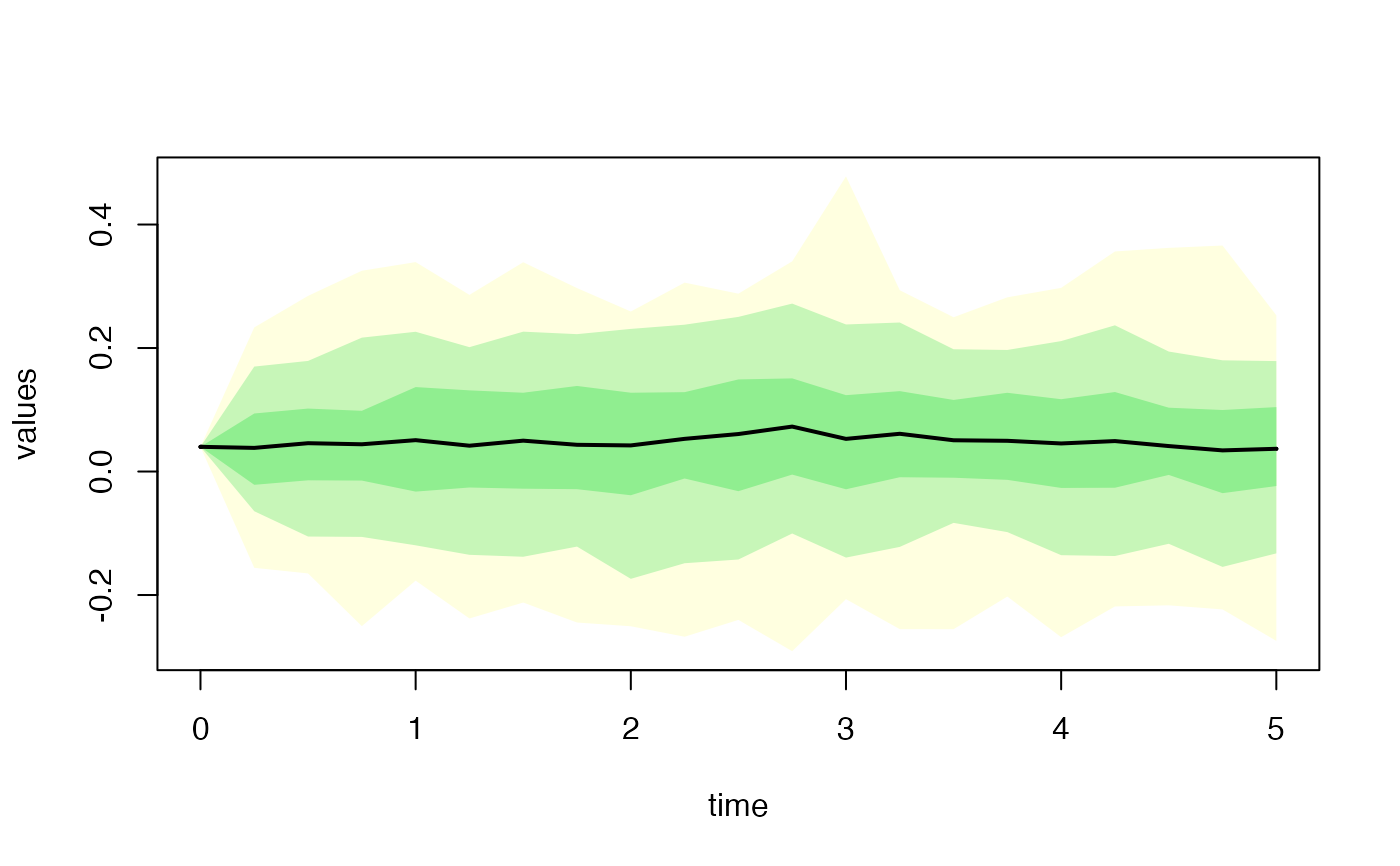

# Times series

kappa <- 1.5

V0 <- theta <- 0.04

sigma <- 0.2

theta1 <- kappa*theta

theta2 <- kappa

theta3 <- sigma

x <- simdiff(n = 100, horizon = 5,

frequency = "quart",

model = "OU",

x0 = V0, theta1 = theta1, theta2 = theta2, theta3 = theta3)

#par(mfrow=c(2,1))

esgplotbands(x, xlab = "time", ylab = "values")

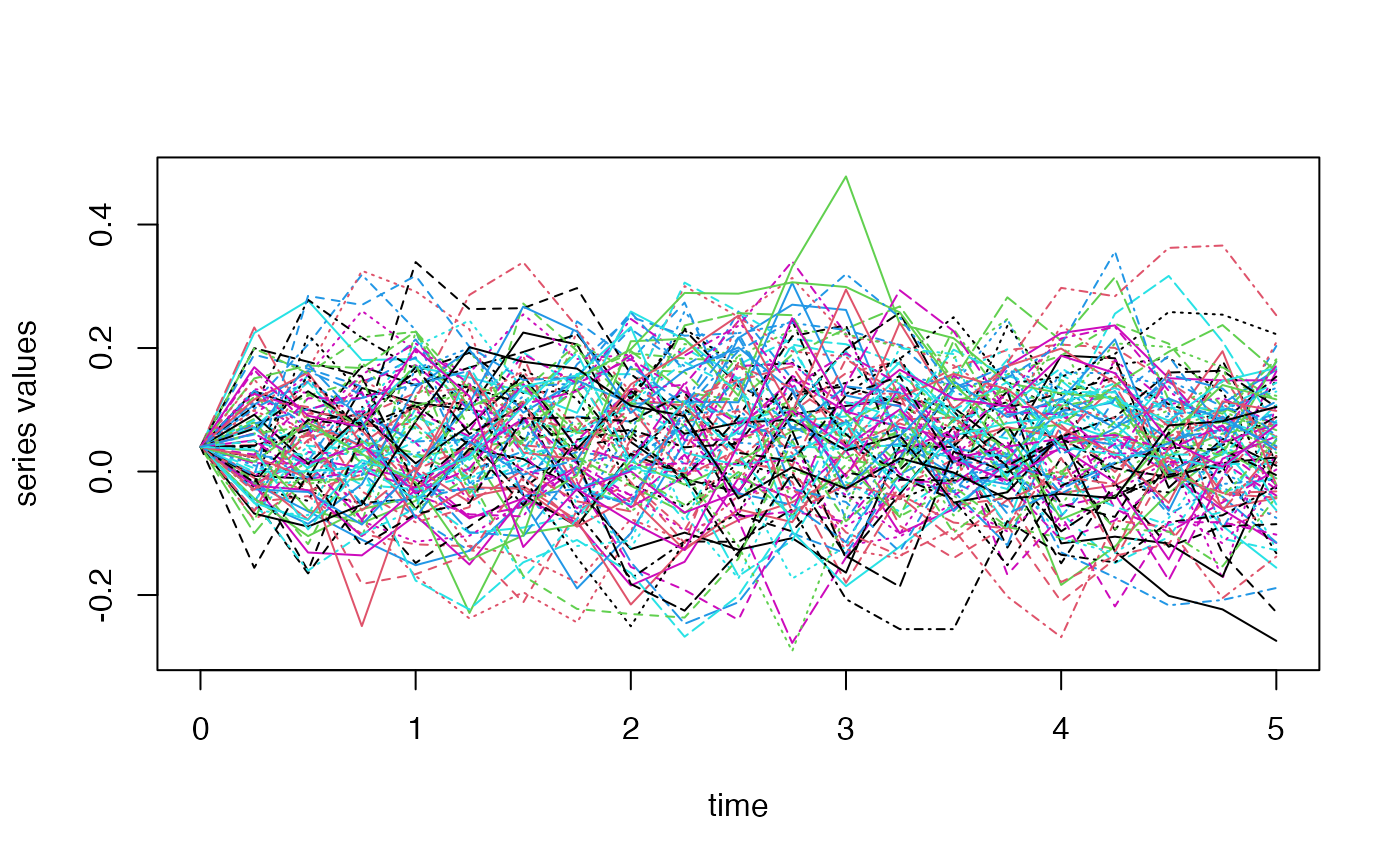

matplot(as.vector(time(x)), x, type = 'l', xlab = "time", ylab = "series values")

matplot(as.vector(time(x)), x, type = 'l', xlab = "time", ylab = "series values")

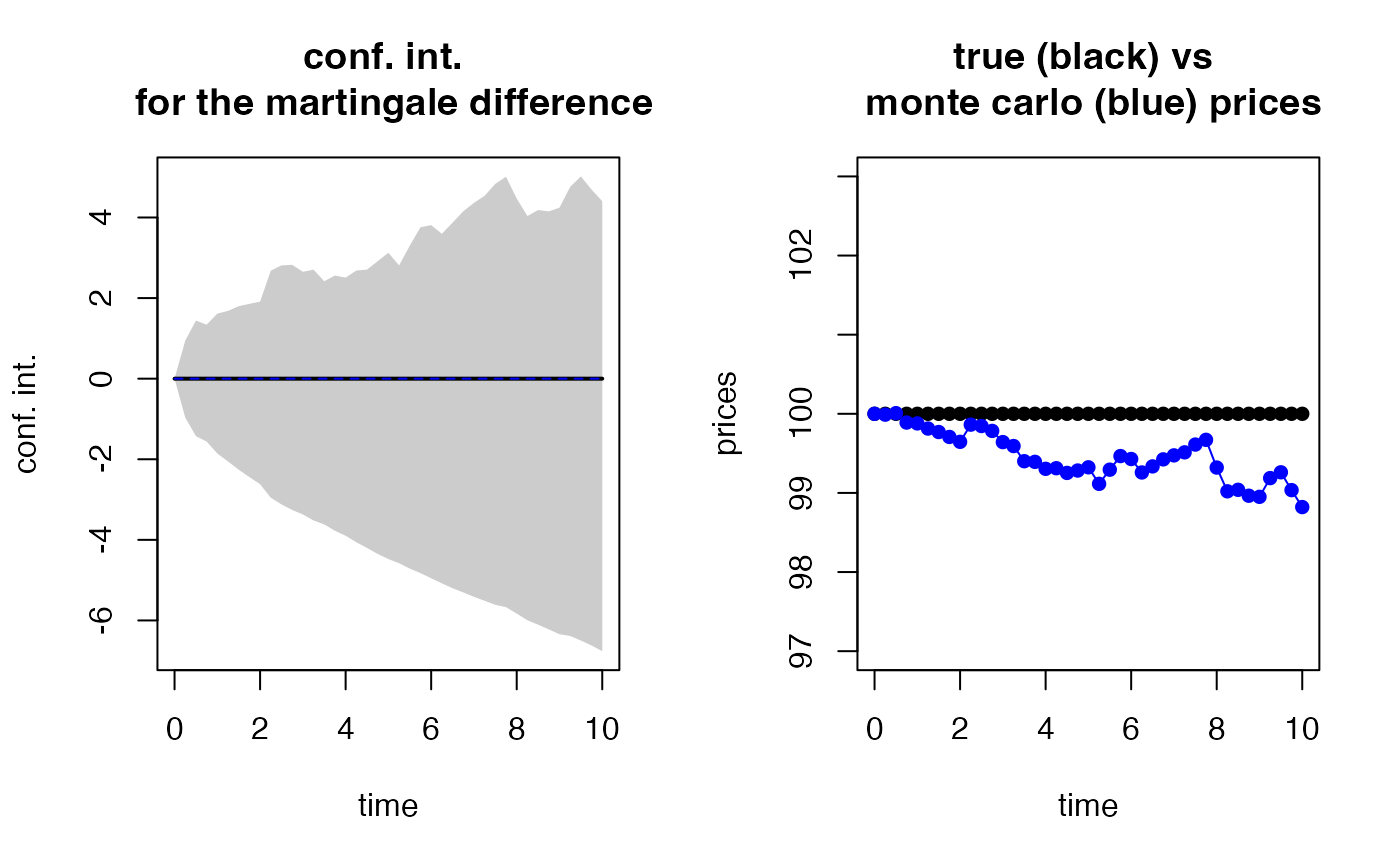

# Martingale test

r0 <- 0.03

S0 <- 100

sigma0 <- 0.1

nbScenarios <- 100

horizon0 <- 10

eps0 <- simshocks(n = nbScenarios, horizon = horizon0, frequency = "quart",

method = "anti")

sim.GBM <- simdiff(n = nbScenarios, horizon = horizon0, frequency = "quart",

model = "GBM",

x0 = S0, theta1 = r0, theta2 = sigma0,

eps = eps0)

mc.test <- esgmartingaletest(r = r0, X = sim.GBM, p0 = S0, alpha = 0.05)

#>

#> martingale '1=1' one Sample t-test

#>

#> alternative hypothesis: true mean of the martingale difference is not equal to 0

#>

#> df = 99

#> t p-value

#> 0 Q2 -1.5893012 0.1151810

#> 0 Q3 -1.0308985 0.3051004

#> 0 Q4 -1.1816807 0.2401632

#> 1 Q1 -0.9994328 0.3200217

#> 1 Q2 -0.9975481 0.3209305

#> 1 Q3 -0.9616265 0.3385801

#> 1 Q4 -0.9648799 0.3369560

#> 2 Q1 -0.9697852 0.3345169

#> 2 Q2 -0.6268720 0.5321861

#> 2 Q3 -0.6069495 0.5452739

#> 2 Q4 -0.6321323 0.5287576

#> 3 Q1 -0.7319134 0.4659505

#> 3 Q2 -0.7397776 0.4611856

#> 3 Q3 -0.8892875 0.3760044

#> 3 Q4 -0.8520924 0.3962194

#> 4 Q1 -0.8972630 0.3717554

#> 4 Q2 -0.8478169 0.3985851

#> 4 Q3 -0.8617621 0.3909010

#> 4 Q4 -0.8027883 0.4240202

#> 5 Q1 -0.7461950 0.4573179

#> 5 Q2 -0.8797694 0.3811148

#> 5 Q3 -0.7223612 0.4717754

#> 5 Q4 -0.5950943 0.5531383

#> 6 Q1 -0.5996844 0.5500866

#> 6 Q2 -0.6835096 0.4958815

#> 6 Q3 -0.6201930 0.5365557

#> 6 Q4 -0.5575577 0.5784050

#> 7 Q1 -0.5188512 0.6050224

#> 7 Q2 -0.4895547 0.6255320

#> 7 Q3 -0.4335887 0.6655305

#> 7 Q4 -0.4019780 0.6885668

#> 8 Q1 -0.5517836 0.5823401

#> 8 Q2 -0.6854329 0.4946727

#> 8 Q3 -0.6607812 0.5102873

#> 8 Q4 -0.6841250 0.4954946

#> 9 Q1 -0.6756343 0.5008480

#> 9 Q2 -0.5573952 0.5785155

#> 9 Q3 -0.5141757 0.6082750

#> 9 Q4 -0.6023588 0.5483125

#> 10 Q1 -0.6864080 0.4940604

#>

#> 95 percent confidence intervals for the mean :

#> c.i lower bound c.i upper bound

#> 0 Q1 0.000000 0.0000000

#> 0 Q2 -1.704155 0.1883292

#> 0 Q3 -2.162324 0.6836831

#> 0 Q4 -2.296103 0.5820486

#> 1 Q1 -2.590482 0.8550150

#> 1 Q2 -2.786158 0.9219423

#> 1 Q3 -2.989586 1.0377748

#> 1 Q4 -3.170991 1.0960333

#> 2 Q1 -3.346892 1.1493536

#> 2 Q2 -3.678659 1.9123091

#> 2 Q3 -3.843892 2.0431211

#> 2 Q4 -3.981028 2.0573271

#> 3 Q1 -4.090321 1.8858902

#> 3 Q2 -4.240255 1.9371331

#> 3 Q3 -4.336025 1.6522132

#> 3 Q4 -4.493488 1.7935944

#> 4 Q1 -4.615875 1.7412037

#> 4 Q2 -4.776183 1.9165219

#> 4 Q3 -4.916665 1.9391341

#> 4 Q4 -5.063956 2.1466419

#> 5 Q1 -5.190505 2.3534762

#> 5 Q2 -5.292663 2.0410253

#> 5 Q3 -5.425924 2.5296641

#> 5 Q4 -5.536569 2.9817938

#> 6 Q1 -5.662485 3.0341306

#> 6 Q2 -5.788609 2.8223605

#> 6 Q3 -5.908501 3.0944961

#> 6 Q4 -6.012426 3.3746828

#> 7 Q1 -6.120358 3.5830279

#> 7 Q2 -6.218107 3.7570037

#> 7 Q3 -6.317987 4.0519588

#> 7 Q4 -6.374286 4.2266636

#> 8 Q1 -6.533080 3.6901422

#> 8 Q2 -6.697632 3.2583963

#> 8 Q3 -6.808017 3.4064195

#> 8 Q4 -6.922402 3.3727911

#> 9 Q1 -7.041456 3.4642265

#> 9 Q2 -7.084925 3.9773675

#> 9 Q3 -7.196704 4.2345033

#> 9 Q4 -7.319541 3.9104080

#> 10 Q1 -7.459425 3.6249599

esgplotbands(mc.test)

# Martingale test

r0 <- 0.03

S0 <- 100

sigma0 <- 0.1

nbScenarios <- 100

horizon0 <- 10

eps0 <- simshocks(n = nbScenarios, horizon = horizon0, frequency = "quart",

method = "anti")

sim.GBM <- simdiff(n = nbScenarios, horizon = horizon0, frequency = "quart",

model = "GBM",

x0 = S0, theta1 = r0, theta2 = sigma0,

eps = eps0)

mc.test <- esgmartingaletest(r = r0, X = sim.GBM, p0 = S0, alpha = 0.05)

#>

#> martingale '1=1' one Sample t-test

#>

#> alternative hypothesis: true mean of the martingale difference is not equal to 0

#>

#> df = 99

#> t p-value

#> 0 Q2 -1.5893012 0.1151810

#> 0 Q3 -1.0308985 0.3051004

#> 0 Q4 -1.1816807 0.2401632

#> 1 Q1 -0.9994328 0.3200217

#> 1 Q2 -0.9975481 0.3209305

#> 1 Q3 -0.9616265 0.3385801

#> 1 Q4 -0.9648799 0.3369560

#> 2 Q1 -0.9697852 0.3345169

#> 2 Q2 -0.6268720 0.5321861

#> 2 Q3 -0.6069495 0.5452739

#> 2 Q4 -0.6321323 0.5287576

#> 3 Q1 -0.7319134 0.4659505

#> 3 Q2 -0.7397776 0.4611856

#> 3 Q3 -0.8892875 0.3760044

#> 3 Q4 -0.8520924 0.3962194

#> 4 Q1 -0.8972630 0.3717554

#> 4 Q2 -0.8478169 0.3985851

#> 4 Q3 -0.8617621 0.3909010

#> 4 Q4 -0.8027883 0.4240202

#> 5 Q1 -0.7461950 0.4573179

#> 5 Q2 -0.8797694 0.3811148

#> 5 Q3 -0.7223612 0.4717754

#> 5 Q4 -0.5950943 0.5531383

#> 6 Q1 -0.5996844 0.5500866

#> 6 Q2 -0.6835096 0.4958815

#> 6 Q3 -0.6201930 0.5365557

#> 6 Q4 -0.5575577 0.5784050

#> 7 Q1 -0.5188512 0.6050224

#> 7 Q2 -0.4895547 0.6255320

#> 7 Q3 -0.4335887 0.6655305

#> 7 Q4 -0.4019780 0.6885668

#> 8 Q1 -0.5517836 0.5823401

#> 8 Q2 -0.6854329 0.4946727

#> 8 Q3 -0.6607812 0.5102873

#> 8 Q4 -0.6841250 0.4954946

#> 9 Q1 -0.6756343 0.5008480

#> 9 Q2 -0.5573952 0.5785155

#> 9 Q3 -0.5141757 0.6082750

#> 9 Q4 -0.6023588 0.5483125

#> 10 Q1 -0.6864080 0.4940604

#>

#> 95 percent confidence intervals for the mean :

#> c.i lower bound c.i upper bound

#> 0 Q1 0.000000 0.0000000

#> 0 Q2 -1.704155 0.1883292

#> 0 Q3 -2.162324 0.6836831

#> 0 Q4 -2.296103 0.5820486

#> 1 Q1 -2.590482 0.8550150

#> 1 Q2 -2.786158 0.9219423

#> 1 Q3 -2.989586 1.0377748

#> 1 Q4 -3.170991 1.0960333

#> 2 Q1 -3.346892 1.1493536

#> 2 Q2 -3.678659 1.9123091

#> 2 Q3 -3.843892 2.0431211

#> 2 Q4 -3.981028 2.0573271

#> 3 Q1 -4.090321 1.8858902

#> 3 Q2 -4.240255 1.9371331

#> 3 Q3 -4.336025 1.6522132

#> 3 Q4 -4.493488 1.7935944

#> 4 Q1 -4.615875 1.7412037

#> 4 Q2 -4.776183 1.9165219

#> 4 Q3 -4.916665 1.9391341

#> 4 Q4 -5.063956 2.1466419

#> 5 Q1 -5.190505 2.3534762

#> 5 Q2 -5.292663 2.0410253

#> 5 Q3 -5.425924 2.5296641

#> 5 Q4 -5.536569 2.9817938

#> 6 Q1 -5.662485 3.0341306

#> 6 Q2 -5.788609 2.8223605

#> 6 Q3 -5.908501 3.0944961

#> 6 Q4 -6.012426 3.3746828

#> 7 Q1 -6.120358 3.5830279

#> 7 Q2 -6.218107 3.7570037

#> 7 Q3 -6.317987 4.0519588

#> 7 Q4 -6.374286 4.2266636

#> 8 Q1 -6.533080 3.6901422

#> 8 Q2 -6.697632 3.2583963

#> 8 Q3 -6.808017 3.4064195

#> 8 Q4 -6.922402 3.3727911

#> 9 Q1 -7.041456 3.4642265

#> 9 Q2 -7.084925 3.9773675

#> 9 Q3 -7.196704 4.2345033

#> 9 Q4 -7.319541 3.9104080

#> 10 Q1 -7.459425 3.6249599

esgplotbands(mc.test)

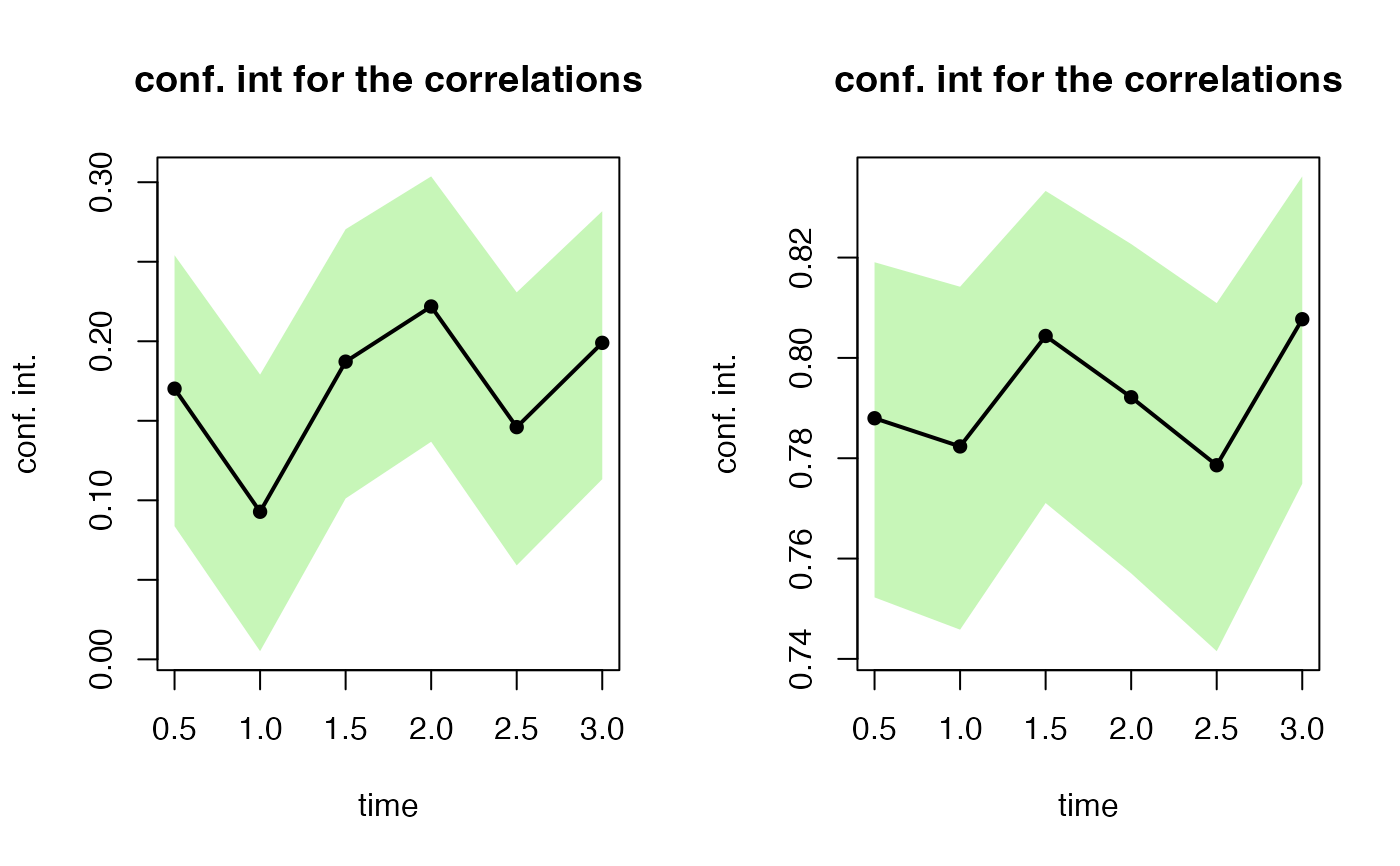

# Correlation test

nb <- 500

s0.par1 <- simshocks(n = nb, horizon = 3, frequency = "semi",

family = 1, par = 0.2)

s0.par2 <- simshocks(n = nb, horizon = 3, frequency = "semi",

family = 1, par = 0.8)

(test1 <- esgcortest(s0.par1))

#> $cor.estimate

#> Time Series:

#> Start = c(0, 2)

#> End = c(3, 1)

#> Frequency = 2

#> [1] 0.17019209 0.09279227 0.18718789 0.22185835 0.14601034 0.19899949

#>

#> $conf.int

#> Time Series:

#> Start = c(0, 2)

#> End = c(3, 1)

#> Frequency = 2

#> Series 1 Series 2

#> 0.5 0.083751429 0.2540906

#> 1.0 0.005143531 0.1790261

#> 1.5 0.101157771 0.2704393

#> 2.0 0.136829774 0.3036416

#> 2.5 0.059076143 0.2307465

#> 3.0 0.113285783 0.2817730

#>

(test2 <- esgcortest(s0.par2))

#> $cor.estimate

#> Time Series:

#> Start = c(0, 2)

#> End = c(3, 1)

#> Frequency = 2

#> [1] 0.7879729 0.7823533 0.8043743 0.7921554 0.7786005 0.8077114

#>

#> $conf.int

#> Time Series:

#> Start = c(0, 2)

#> End = c(3, 1)

#> Frequency = 2

#> Series 1 Series 2

#> 0.5 0.7522620 0.8190677

#> 1.0 0.7458304 0.8141866

#> 1.5 0.7710721 0.8332881

#> 2.0 0.7570532 0.8226977

#> 2.5 0.7415392 0.8109245

#> 3.0 0.7749064 0.8361767

#>

#par(mfrow=c(2, 1))

esgplotbands(test1)

esgplotbands(test2)

# Correlation test

nb <- 500

s0.par1 <- simshocks(n = nb, horizon = 3, frequency = "semi",

family = 1, par = 0.2)

s0.par2 <- simshocks(n = nb, horizon = 3, frequency = "semi",

family = 1, par = 0.8)

(test1 <- esgcortest(s0.par1))

#> $cor.estimate

#> Time Series:

#> Start = c(0, 2)

#> End = c(3, 1)

#> Frequency = 2

#> [1] 0.17019209 0.09279227 0.18718789 0.22185835 0.14601034 0.19899949

#>

#> $conf.int

#> Time Series:

#> Start = c(0, 2)

#> End = c(3, 1)

#> Frequency = 2

#> Series 1 Series 2

#> 0.5 0.083751429 0.2540906

#> 1.0 0.005143531 0.1790261

#> 1.5 0.101157771 0.2704393

#> 2.0 0.136829774 0.3036416

#> 2.5 0.059076143 0.2307465

#> 3.0 0.113285783 0.2817730

#>

(test2 <- esgcortest(s0.par2))

#> $cor.estimate

#> Time Series:

#> Start = c(0, 2)

#> End = c(3, 1)

#> Frequency = 2

#> [1] 0.7879729 0.7823533 0.8043743 0.7921554 0.7786005 0.8077114

#>

#> $conf.int

#> Time Series:

#> Start = c(0, 2)

#> End = c(3, 1)

#> Frequency = 2

#> Series 1 Series 2

#> 0.5 0.7522620 0.8190677

#> 1.0 0.7458304 0.8141866

#> 1.5 0.7710721 0.8332881

#> 2.0 0.7570532 0.8226977

#> 2.5 0.7415392 0.8109245

#> 3.0 0.7749064 0.8361767

#>

#par(mfrow=c(2, 1))

esgplotbands(test1)

esgplotbands(test2)